how to do income tax

It doesnt tax the family unit. If this deadline is missed by the individual taxpayers then they have an option to file a belated income tax return.

Do You Need To File An Income Tax Return In 2019

PayPal Reporting Rules.

. Form 1120 US. This guide is also available in Welsh Cymraeg. You do not have to pay tax on all types of income.

The Australian tax system taxes the individual Ms Morton says. Companies that do business in multiple states face the challenge of tracking corporate income tax laws in multiple perhaps many places. The last date for filing income tax return ITR for FY 2021-22 AY 2022-23 is July 31 2022.

Corporation Income Tax Return PDF due by the 15th day of the 3rd month after the end of the organizations tax year. Content provided by Income Tax Department Mumbai. You pay tax on things like.

The question before voters is a. On top of that sales tax laws are complex and frequently change. Income caps to qualify.

From the 20172018 income year your business is eligible for the lower rate if its a base rate entity. 5 Do I need to file a state tax return. The Income Tax Course consists of 62 hours of instruction at the federal level 68 hours of instruction in Maryland 80 hours of instruction in California and 81 hours of instruction in Oregon.

The full company tax rate is 30 and the lower company tax rate is 275. Additional time commitments outside of class including homework will vary by student. Even if you cant pay it all immediately pay as much as you can.

How to file corporate tax returns for companies. The standard tax extension allows you to file your tax return after the usual deadline. In case of doubt reference should always be made to the relevant provisions of the Direct Tax Laws and Rules and where necessary notifications issued from time to time.

What challenges might tax teams face when calculating apportionment. If you receive payments through PayPal you may or may not receive IRS. Guided Tax Preparation provides free online tax preparation and filing at an IRS partner site.

The report contains data on sources of income adjusted gross income exemptions deductions taxable income income tax modified. Economic security programs. About 11 percent or 665 billion of the federal budget in 2022 supports programs that provide aid other than health insurance or Social Security benefits to individuals and families facing hardshipEconomic security programs include.

What are the consequences for late filing or non filing of Corporate Income Tax Returns. If you pay an IRS or state penalty or interest because of a TurboTax calculation error well pay you the penalty and interest. Improving Lives Through Smart Tax Policy.

Do I need to file an income tax return. Earned Income Tax Credit EIC Child tax credits Student loan interest deduction More Important Details and Disclosures. Paying any tax due.

More Income Tax Information State Income Tax. Sometimes state tax returns will not be processed electronically if a federal tax return is not processed first. Free File Fillable Forms are electronic federal tax forms equivalent to a paper 1040 form.

Although it does recognise elements of the family in other ways. 100 Accurate Calculations Guarantee. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates. Frequently Asked Tax Questions And Answers. Additional training or testing may be required in CA OR and.

Most retirement income can be subject to federal income taxes. Some states tax social security and some states do not. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

Common Tax Reliefs that will help to reduce the tax bill for Companies. One other nuance it depends on the type of tax cut. The statistics are based on a sample of individual income tax returns selected before audit which represents a population of Forms 1040 1040A and 1040EZ including electronic returns.

This November Massachusetts voters will decide whether the states constitution should be amended to transition the Bay State from a flat rate individual income tax to a graduated rate system through the imposition of a 4 percent surtax on income over 1 million. The rebates are limited to individuals reporting adjusted gross incomes of 150000 or less on taxes 225000 for those filing as head of household and 300000 for joint. However it doesnt buy you more time to pay any taxes you may oweThat means that if you dont pay your tax balance by the filing deadline youll get hit with penalty and interest.

Taxes are unavoidable and without planning the annual tax liability can be very uncertain. You can imagine how cutting taxes for lower earners might boost activity more than cutting the top marginal rate lower-income Americans. Do I need to pay corporate tax on.

For any clarification regarding content please contact the PRO Income Tax Department Mumbai. Contains complete individual income tax data. However filing a belated ITR.

Corporation tax law changes. The fourth and fifth SEISS grants form part of your taxable profits for 202122 and for tax credit purposes as most self-employed claimants use their taxable profit figure from their tax return when declaring income for tax credit purposes which will include the SEISS grant income no further adjustments should be necessary in relation to. Each state has different filing requirements and income thresholds for filing tax returns.

You may also have to file a New York State return if youre a nonresident of New York and you have income from New York State sources. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal. Income Tax is a tax you pay on your income.

Find your answer online. Retirement Income Tax Basics. Federal income taxes on Roth contributions are paid before the contributions are made.

Income Tax Return for Estates and Trusts PDF due by the 15th day of the 4th month after the end of your organizations tax year. Our partners deliver this service at no cost to qualifying taxpayers. Under a law passed in 2012 third-party payment services must report income received by taxpayers.

That includes Social Security benefits pension payments and distributions from IRA and 401k plansExceptions include distributions from Roth IRA and Roth 401k plans. Generally you must file a New York State income tax return if youre a New York State resident and are required to file a federal return. Taxpayers whose AGI is 73000 or less qualify for a free federal tax return.

The refundable portions of the Earned Income Tax Credit and Child Tax Credit which assist low-. Multi-state apportionment can be a concern. Tax information for individuals.

An automatically revoked organization is not eligible to. CityCounty Business Tax CCBT Program - Identifies individuals and businesses with certain filing requirements.

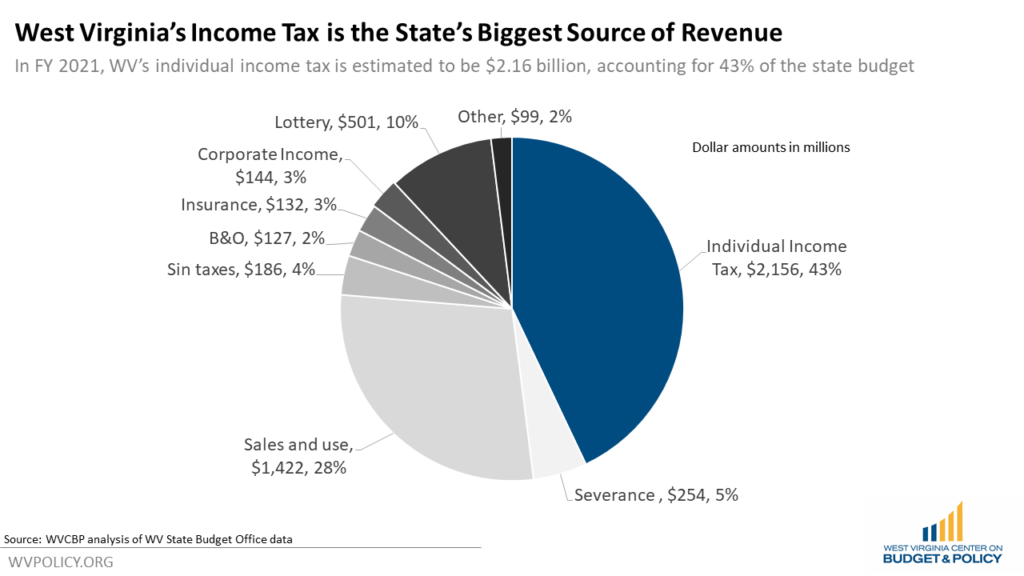

How Do You Pay For A 2 1 Billion Tax Cut West Virginia Center On Budget Policy

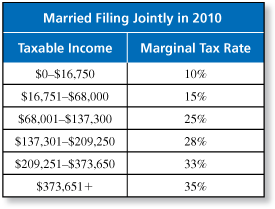

Math You 5 2 Graduated Income Tax Page 218

How To File Taxes Online 13 Steps With Pictures Wikihow

How To File A Zero Income Tax Return 11 Steps With Pictures

Survey Confirms That Many Americans Misunderstand Income Tax Brackets American Enterprise Institute Aei

How To Find Out How Much You Paid In Income Taxes On Your 1040

How Do Food Delivery Couriers Pay Taxes Get It Back

Income Tax Swap Passes House On 2nd Try Now Goes To Senate Here S What It Would Do Legislature Theadvocate Com

Do You Qualify For The Earned Income Tax Credit Child Advocacy

How To Do E Filing Income Tax Return Usa Tax Return Filing

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Determine Your Tax Bracket Mintlife Blog

How Do Federal Income Tax Rates Work Tax Policy Center

A Checklist What Documents You Need To Prepare Your Taxes

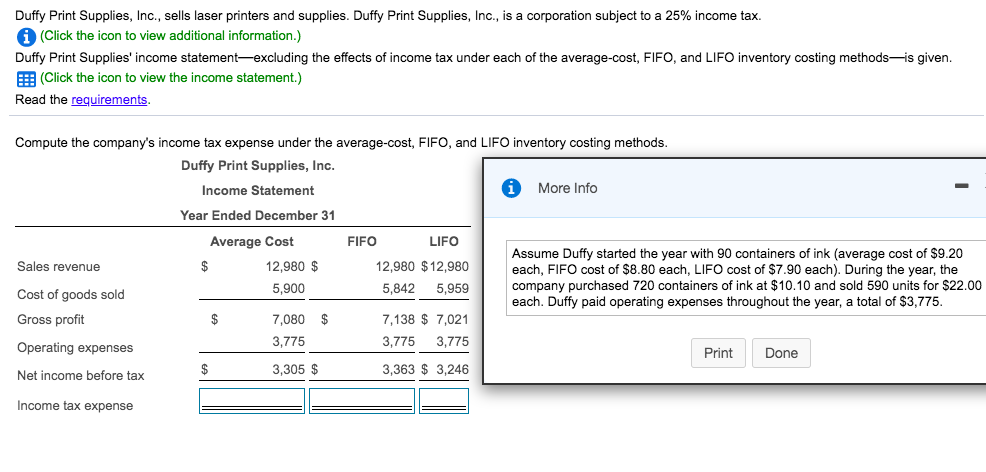

Solved How Do I Calculate Income Tax Expense For Average Chegg Com

2022 Filing Taxes Guide Everything You Need To Know

Ugh What You Need To Know About Filing Your 2021 Tax Return With The Dysfunctional Irs

What Is Irs Form 1040 Es Guide To Estimated Income Tax Bench Accounting

Comments

Post a Comment